|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☑☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material |

ARROW ELECTRONICS, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

|

|

|

| ||

| No fee required. | |

☐ | Fee paid previously with preliminary materials. |

☐ | Fee computed on table |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

OUR |

200 Inverness Drive West |

March 28, 201826, 2024

Dear Shareholder:

| |

You are invited to Arrow’sArrow Electronics, Inc.’s (“Arrow” or the “Company”) Annual Meeting of Shareholders (“Annual Meeting”) on Thursday,Wednesday, May 10, 2018.7, 2024. The formal notice of the Annual Meeting and the Proxy Statement soliciting your vote at the Annual Meeting appear on the following pages.

| ||||

The matters scheduled to be considered at the Annual Meeting are: |

| Arrow’s Board | ||

> | the election of the directors named in the Proxy Statement to serve as members of Arrow’s Board of | | | |

> | the ratification of the | | | |

> | the holding of an advisory vote | | | |

These matters are discussed more fully in the Proxy Statement. | | | ||

| | | ||

Under the rules adopted by the United StatesU.S. Securities and Exchange Commission (“SEC”), we are furnishing proxy materials to our shareholders online rather than mailing printed copies to each shareholder. Accordingly, you will not receive a printed copy of the proxy materials unless you request one. The Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting (the “Notice”(“Notice”) includes instructions on how to access and review the proxy materials, and how to access your proxy card and vote online. If you would like to receive a printed copy of ourthe proxy materials, please follow the instructions included in the Notice.

Please make sure you vote whether or not you plan to attend the Annual Meeting. You can cast your vote in person at the Annual Meeting, online by following the instructions on either the proxy card or the Notice, by telephone, or, if you received paper copies of ourthe proxy materials, by mailing your proxy card in the postage-paidpostage - paid return envelope.

| |

| |

|

WHEN:

WHERE: The Englewood, Colorado AGENDA: 1. Elect the directors named in the Proxy Statement to serve as members of Arrow’s Board of Directors 2. Ratify the appointment of Ernst & Young LLP as Arrow’s independent registered public accounting firm for the fiscal year ending December 31, 3. Hold an advisory vote 4. Transact such other business as may properly come before the Annual Meeting or any adjournments or postponements thereof. |

| NOTICE OF ANNUAL MEETING | ||||||||

| | March You are invited to Arrow’s Annual Shareholders can vote online, by telephone, by completing and returning the proxy card, or by attending the Annual Meeting. The Notice and the proxy card | ||||||||

|

|

|

|

|

| |||||

|

|

| ||||||||

Internet | Telephone | Mail | In Person | |||||||

| | Shareholders may revoke a proxy (change or withdraw their votes) at any time prior to the Annual Meeting by following the instructions in the Proxy Statement.

The proxy materials and Arrow’s | ||||||||

| | |

| | By Order of the Board of Directors, |

|

|

|

|

| Carine L. Jean-Claude Corporate Secretary |

Important Notice Regarding the Availability of Proxy Materials

for the Shareholder Meeting to be Held on May 7, 2024

LETTER FROM THE PRESIDENT AND CHIEF EXECUTIVE OFFICER

First and foremost, thank you for your continued investment and confidence in Arrow Electronics.

At Arrow, our diverse team of employees across the world works to bridge the gap between what’s possible and the practical technologies to make it happen. We guide innovation forward by driving demand and expanding addressable markets for our suppliers and customers via our technology-centric focus, go-to-market expertise, and supply chain services capabilities. We enable our suppliers to distribute their technologies and help our customers to source, build upon, and leverage these technologies to grow their businesses and enhance their overall competitiveness. We are a trusted partner in a complex value chain and are uniquely positioned through our electronics components and IT content portfolios to increase stakeholder value.

Through our Five Years Out mindset, we consistently inspire and deliver on our purpose: We enable technology solutions that make a positive difference in people’s lives; we guide the power of innovation to make the world better. Further, we understand the vital role we each play for the good of our business and stakeholders. Our talented global and multicultural workforce powers our performance and value to all.

In 2023, we delivered solid financial results despite a challenging market environment. Though several of the external factors we navigated were unfavorable, the team made great progress on our value-added offerings, in which we have invested to drive structural margin improvements for the business. We were able to accomplish these results while maintaining our relentless focus on delivering excellence for our customers and suppliers, as well as our unwavering commitment to demonstrating our core Arrow values. We are: ethical in how we conduct business; open-minded and courageous as we engage stakeholders; results-oriented and accountable for the quality and outcome of our work; innovative to grow value for stakeholders; and customer - centric to earn trust, loyalty, and repeat business.

As we move through an ongoing cyclical correction and weaker macro demand environment, we are optimistic regarding the overall industry backdrop. We believe longer-term technology trends will benefit Arrow especially since we are at the center of large and growing markets, driven by the electrification of everything including renewable energy, artificial intelligence, and autonomous vehicles. Going forward, the Board and management team remain focused on enhancing more accretive growth initiatives and prudently managing our cost structure and working capital portfolio to emerge from this period in a position to continue to generate long-term value for our shareholders, suppliers, and customers.

I invite you to read more about Arrow’s corporate governance and executive compensation practices in the following pages. As always, we welcome your input and value your support.

| | |

| Sincerely, | |

|

| |

| Sean J. Kerins | |

| President and Chief Executive Officer | |

ARROW ELECTRONICS, INC.Annual Meeting of ShareholdersANNUAL MEETING OF SHAREHOLDERSTo Be Held May 10, 2018TO BE HELD MAY 7, 2024

TABLE OF CONTENTS

1 | |

| |

1 | |

1 | |

1 | |

2 | |

2 | |

2 | |

3 | |

3 | |

| |

4 | |

| |

4 | |

| 5 |

| |

6 | |

| |

6 | |

6 | |

7 | |

8 | |

8 | |

8 | |

9 | |

10 | |

| |

11 | |

| |

The Board Recommends a Vote “For” All of the Nominees Named Below | 11 |

11 | |

12 | |

13 | |

15 | |

17 | |

| |

24 | |

| |

25 | |

| |

25 | |

26 | |

27 | |

28 | |

29 | |

30 | |

30 | |

30 | |

| 31 |

32 | |

33 | |

33 | |

33 | |

34 | |

34 | |

34 | |

35 | |

35 | |

37 | |

| |

38 | |

| |

39 | |

| |

Proposal 2 | 40 |

| |

40 | |

| 42 |

| |

42 | |

| |

| |

48 | |

48 | |

48 | |

50 | |

| 50 |

50 | |

| 51 |

| 56 |

60 | |

60 | |

61 | |

61 | |

61 | |

| |

63 | |

63 | |

63 | |

64 | |

65 | |

65 | |

65 | |

| |

67 | |

| |

68 | |

| |

68 | |

69 | |

70 | |

71 | |

Stock Vested and Options Exercised | 73 |

74 | |

74 | |

| |

Agreements and Potential Payouts upon Termination or Change | 76 |

| |

76 | |

77 | |

77 | |

78 | |

79 | |

84 | |

| |

85 | |

| |

| 87 |

| |

91 | |

| |

92 | |

| |

93 | |

| |

94 | |

|

|

95 | |

| |

96 | |

97 | |

98 |

In Connection with the 2018 Annual Meeting Information

THE PURPOSE OF THIS PROXY STATEMENT

The Board of Directors of Arrow, Electronics, Inc., a New York corporation, (“Arrow” or the “Company”), is furnishing this Proxy Statement to shareholders of record to solicit proxies to be voted at the 2018 Annual Meeting. By returning a completed proxy card, or voting over theby telephone or internet, you are giving instructions on how your shares are to be voted at the Annual Meeting. TheThis Proxy Statement isand the form of proxy are first being made available through www.proxyvote.com.to shareholders of record on or about March 26, 2024.

| | | |

| | Invitation to the Shareholders of record at the close of business on March 11, 2024, are invited to attend the Annual Meeting on Tuesday, May 7, 2024, beginning at 8:00 a.m. MT. The Annual Meeting will be held at: The Inverness Denver, a Hilton Golf & Spa Resort 200 Inverness Drive West | |

Please vote your shares by telephone or online, or if you received printed copies of the proxy materials, complete, sign, and date your proxy card and return it promptly in the postage-paid return envelope provided. If your shares are held in “street name” (that is, in the name of a bank, broker, or other holder of record), Unless you indicate otherwise, the persons named as proxies on the proxy card will vote your shares represented in a properly executed proxy card “FOR” all of the nominees for director named in this Proxy Statement, “FOR” the ratification of the appointment of Ernst & Young LLP as Arrow’s independent registered public accounting firm for the fiscal year ending December 31, 2024, and “FOR” approval of the named executive officer compensation as described in the Compensation Discussion and Analysis (“CD&A”) section contained herein. | | | |

|

|

Only shareholders of record of Arrow’s common stock at the close of business on March 12, 2018 (the “Record11, 2024 (“Record Date”) are entitled to notice of and to vote at the Annual Meeting. As of the Record Date, there were 87,633,88653,978,667 shares of Arrow common stock outstanding. Each share of common stock is entitled to one vote on each matter properly brought before the Annual Meeting. The presence in person or by proxy of a majority of the shares entitled to vote at the Annual Meeting shallwill constitute a quorum.

For those who hold shares as a participant in Arrow’s 401(k) Plan, the shareholder has the right to direct Vanguard Fiduciary Trust Company (the “Trustee”), who is the holderA complete list of record, howshareholders entitled to vote the shares of common stock credited to the participant’s account at the Annual Meeting. If voting instructions for the shares of common stock in the 401(k) Plan are not received, those sharesMeeting will be voted byopen to the Trustee inexamination of any shareholder during the same proportions as the shares for which voting instructions were received from other participants in the 401(k) Plan. Voting (including any revocations) by 401(k) Plan participants will close at 11:59 p.m. Eastern Time on May 7, 2018. The Trustee will then vote all shares of common stock held in the 401(k) Plan by the established deadline. For all other shareholders, voting (including any revocations) will close at 11:59 p.m. Eastern Time on May 9, 2018.Annual Meeting.

The person giving a proxy may revoke it at any time prior to the time it is voted at the Annual Meeting by giving written notice to Arrow’s Corporate Secretary, Gregory Tarpinian,Carine L. Jean-Claude, at Arrow Electronics, Inc., 92019151 East Dry Creek Road,Panorama Circle, Centennial, Colorado 80112. If the proxy was given by telephone or through the internet, it may be revoked in the same manner.by voting again via telephone or internet. You may also revokewithdraw your proxy by attending the Annual Meeting and voting in person. If your shares are held in “street name,” you must contact the record holder of the shares regarding how to revoke your proxy.

Arrow pays the cost of soliciting proxies. Arrow has retained D.F. King & Co., Inc. to assist in soliciting proxies at an anticipated cost of approximately $20,000, plus expenses. Arrow will supply soliciting materials to the brokers, fiduciaries, and other nomineescustodians holding Arrow common stock in a timely manner so that the brokers, fiduciaries, and other nomineescustodians may send the materialmaterials to each beneficial owner. Arrow will reimburse the brokers, fiduciaries, and other nomineescustodians for their expenses in so doing. In addition to this solicitation by mail, the Board, employees, and agents of the Company may solicit proxies in person, by electronic transmission, or by telephone.

2024 ANNUAL |

| ||

| |||

PROPOSAL | BOARD’S VOTING RECOMMENDATION | ||

|

| FOR Each Nominee | |

|

|

| |

2 | |||

| Ratification of the appointment of Ernst & Young LLP as Arrow’s independent registered public accounting firm for the fiscal year ending December 31, | FOR | |

| | | |

3 | Advisory vote | FOR | |

| | | |

Shareholders can vote online, by telephone, by completing and returning the proxy card, or by attending the Annual Meeting. The Notice and the proxy card have detailed instructions for voting, including voting deadlines. | |||

|

|

|

|

Internet | Telephone | Mail | In Person |

Arrow’s Board | |||

|

| 3 |

|

|

CERTAIN SHAREHOLDERS

HOLDERS OF MORE THAN 5% OF COMMON STOCK

The following Tabletable sets forth certain information with respect to the only shareholders known to the Company to own beneficially more than 5% of the outstanding common stock of Arrow as of March 12, 2018.11, 2024, unless otherwise noted.

|

|

|

|

|

|

|

|

|

|

|

|

Name and Address |

| Number of Shares |

| Percent of | |

of Beneficial Owner |

| Beneficially Owned |

| Class | |

BlackRock Inc. (1) |

|

|

|

|

|

55 East 52nd Street |

|

|

|

|

|

New York, New York 10055 |

| 8,300,258 |

| 9.5 | % |

The Vanguard Group (2) |

|

|

|

|

|

100 Vanguard Boulevard |

|

|

|

|

|

Malvern, Pennsylvania 19355 |

| 7,711,447 |

| 8.8 | % |

Wellington Management Group LLP (3) |

|

|

|

|

|

280 Congress Street |

|

|

|

|

|

Boston, Massachusetts 02210 |

| 5,894,482 |

| 6.7 | % |

JPMorgan Chase & Co. (4) |

|

|

|

|

|

270 Park Avenue |

|

|

|

|

|

New York, New York 10017 |

| 5,402,362 |

| 6.2 | % |

Boston Partners (5) |

|

|

|

|

|

One Beacon Street - 30th Floor |

|

|

|

|

|

Boston, Massachusetts 02108 |

| 5,382,351 |

| 6.1 | % |

| | | | | |

Name and Address |

| Shares of Common Stock |

| % of Outstanding | |

| | Beneficially Owned | | Common Stock | |

BlackRock, Inc. (1) |

| |

| | |

50 Hudson Yards | | | | | |

New York, New York 10001 | | 5,469,589 | | 10.13 | % |

The Vanguard Group (2) | | | | | |

100 Vanguard Boulevard | | | | | |

Malvern, Pennsylvania 19355 | | 6,211,177 | | 11.51 | % |

| (1) |

| Based upon a Schedule |

|

|

|

|

| (2) |

| Based upon a Schedule |

|

|

4 |

| |

2024 ANNUAL |

| ||

| |||

SHAREHOLDINGS OF DIRECTORS AND EXECUTIVE OFFICERS AND DIRECTORS

The following Tabletable shows as of March 12, 2018, the beneficial ownership of the Company’s common stock, as of March 11, 2024, for each director and director nominee, each of the “Named Executive Officers” (the Chief Executive Officer,identified in the Chief Financial Officer,CD&A and each of the other three most highly compensatedall directors, director nominees, and executive officers of the Company, referred to as the “NEOs”), and other executive officers who file Section 16(a) reports.a group.

|

|

|

|

|

|

|

|

|

| |||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

| | | | | | | | | | | | |||||||||

Shares of Common Stock Beneficially Owned | Shares of Common Stock Beneficially Owned | Shares of Common Stock Beneficially Owned | ||||||||||||||||||

|

| Currently |

| Common |

| Acquirable |

| % of Outstanding | ||||||||||||

| | Currently | | Common | | Acquirable | | Total | | % of Outstanding | | |||||||||

Name |

| Owned (1) |

| Stock Units (2) |

| within 60 Days |

| Common Stock |

| Owned (1) |

| Stock Units (2) |

| within 60 Days |

| Ownership |

| Common Stock | | |

Sean J. Kerins | | 142,094 | | — | | — | | 142,094 | | * | | |||||||||

Steven H. Gunby | | — | | 17,855 | | 2,722 | | 20,577 | | * | | |||||||||

William F. Austen | | 2,970 | | 1,469 | | 1,520 | | 5,959 | | * | | |||||||||

Fabian T. Garcia | | — | | 2,720 | | 1,520 | | 4,240 | | * | | |||||||||

Gail E. Hamilton | | 101 | | 22,119 | | 1,520 | | 23,740 | | * | | |||||||||

Michael D. Hayford | | — | | — | | — | | — | | * | | |||||||||

Andrew C. Kerin | | — | | 25,915 | | 1,520 | | 27,435 | | * | | |||||||||

Carol P. Lowe | | — | | 4,523 | | 1,520 | | 6,043 | | * | | |||||||||

Mary T. McDowell | | — | | — | | 1,520 | | 1,520 | | * | | |||||||||

Gerry P. Smith | | — | | 3,896 | | 1,520 | | 5,416 | | * | | |||||||||

Rajesh K. Agrawal | | 6,894 | | — | | — | | 6,894 | | * | | |||||||||

Gretchen K. Zech | | 65,160 | | — | | — | | 65,160 | | * | | |||||||||

Kristin D. Russell | | 10,765 | | — | | — | | 10,765 | | * | | |||||||||

Carine L. Jean-Claude | | 15,585 | | — | | — | | 15,585 | | * | | |||||||||

Michael J. Long |

| 473,768 |

| — |

| — |

| * |

| | 87,017 | | — | | — | | 87,017 | | * | |

Christopher D. Stansbury |

| 41,662 |

| — |

| — |

| * |

| |||||||||||

Sean J. Kerins |

| 65,273 |

| — |

| — |

| * |

| |||||||||||

Andrew D. King |

| 52,912 |

| — |

| — |

| * |

| |||||||||||

Gretchen K. Zech |

| 46,929 |

| — |

| — |

| * |

| |||||||||||

Barry W. Perry |

| — |

| 57,956 |

| — |

| * |

| |||||||||||

Philip K. Asherman |

| — |

| 28,332 |

| — |

| * |

| |||||||||||

Steven H. Gunby |

| — |

| 220 |

| — |

| * |

| |||||||||||

Gail E. Hamilton |

| 91 |

| 22,605 |

| — |

| * |

| |||||||||||

Richard S. Hill |

| 4,891 |

| 28,463 |

| — |

| * |

| |||||||||||

M.F. (Fran) Keeth |

| — |

| 36,392 |

| — |

| * |

| |||||||||||

Andrew C. Kerin |

| 4,891 |

| 19,426 |

| — |

| * |

| |||||||||||

Stephen C. Patrick |

| — |

| 46,869 |

| — |

| * |

| |||||||||||

Total Executive Officers’ and Directors’ Beneficial Ownership as a group (18 individuals) |

| 892,090 |

| 240,263 |

| — |

| 1.3 | % | |||||||||||

Kirk D. Schell | | — | | — | | — | | — | | * | | |||||||||

Total Directors’, Director Nominees', and Current Executive Officers’ Beneficial Ownership as a Group (15 individuals) | | 250,274 | | 78,497 | | 13,362 | | 342,133 | | 0.6 | % | |||||||||

*Represents holdings of less than 1%.

* |

|

| (1) | Includes |

| (2) |

| Includes common stock units deferred by non-management directors and restricted stock units granted under the Omnibus Incentive Plan. |

|

| 5 |

|

|

PROXY STATEMENT HIGHLIGHTS

COMPANY OVERVIEW

Arrow is a global provider of products, services, and solutions to industrial and commercial users of electronic components and enterprise computing solutions. Arrow has one of the world’s broadest portfolios of product offerings available from leading electronic components and enterprise computing solutions suppliers. These product offerings, coupled with a range of services, solutions, and software, help industrial and commercial customers introduce innovative products, reduce time to market, and enhance overall competitiveness.

Arrow believes that economic success comes from more than just financial growth. As technology’s benefits reach more people, Arrow’s addressable market continues to expand, promoting a healthy economy.

BOARD Leadership Transition

In 2023, Mr. Long concluded his term as Executive Chair of the Board following the 2023 annual shareholder meeting.

In connection with this transition, the Board appointed Mr. Gunby to serve as independent Board Chair based on his independence, deep understanding of Arrow’s business, valuable contributions to the Board during his tenure as a director, and relevant background and experience.

6 |

| |

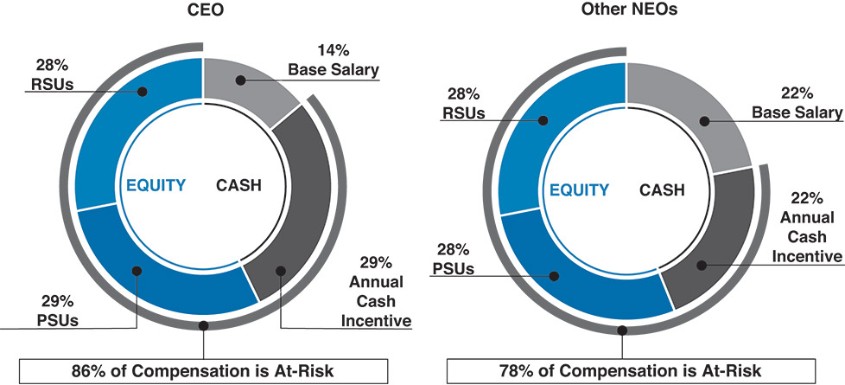

EXECUTIVE COMPENSATION HIGHLIGHTS

Components of 2023 Compensation Program

CEO | Other NEOs | Description | ||||||

| | | | | | | | |

| | | | Annual Base Salary | ||||

| | | |

| |

| | > Base salary is set at market-competitive levels relative to comparable jobs at similar companies and also reflects the experience, potential, and performance of executives |

CASH | | | | | | | | |

Annual Cash Incentive Compensation | ||||||||

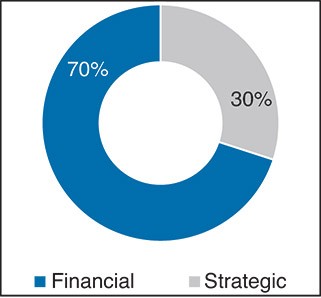

| |

| |

| | > Annual cash incentives are performance-based rewards for the attainment of pre-established financial and strategic targets > Based on financial and quantitative strategic metrics – Absolute EPS (70%) and Strategic Goals (30%) | ||

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

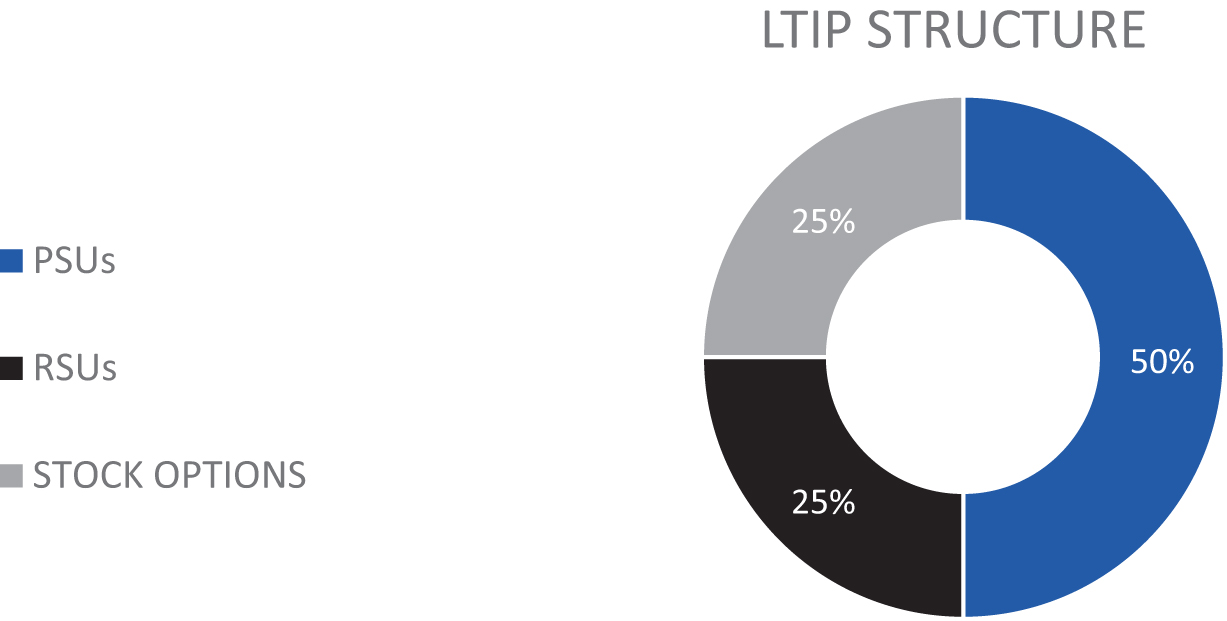

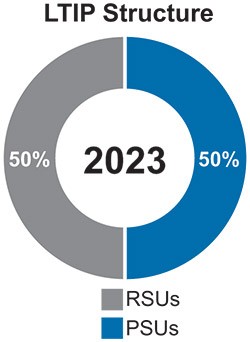

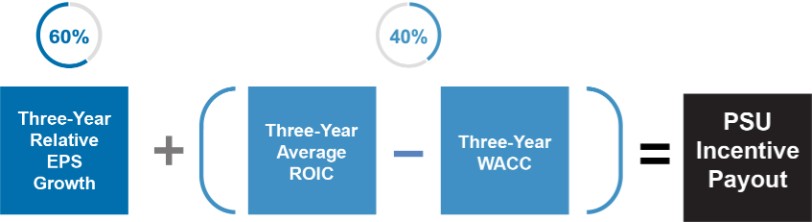

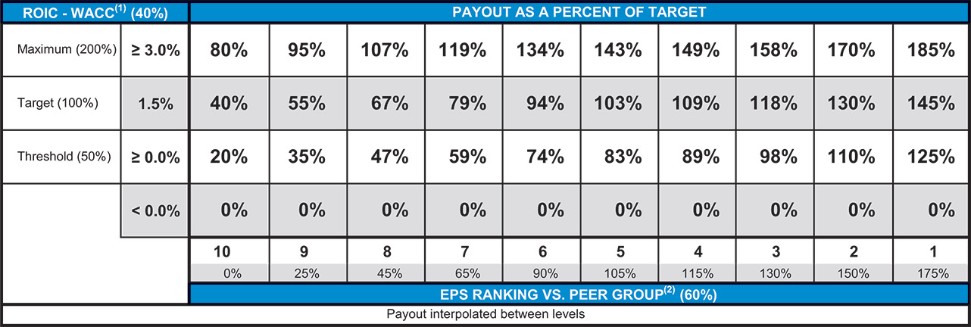

| | | | Long-Term Incentive Compensation | ||||

| | | |

| |

| | > Long-term incentives are designed to promote a balanced focus on driving performance, retaining talent, and aligning the interests of the Company’s executives with those of its shareholders > 50% Performance Stock Units and 50% Restricted Stock Units |

EQUITY | ||||||||

| | | | | ||||

| | | | |||||

| | | | | | | | |

|

| 7 |

CORPORATE GOVERNANCE HIGHLIGHTs

Arrow believes that good corporate governance is critical to achieving long-term shareholder value. The following table highlights some of Arrow’s corporate governance practices and policies:

● ● ● ● ● ● ● ● ● | ● ● ● ● ● ● ● |

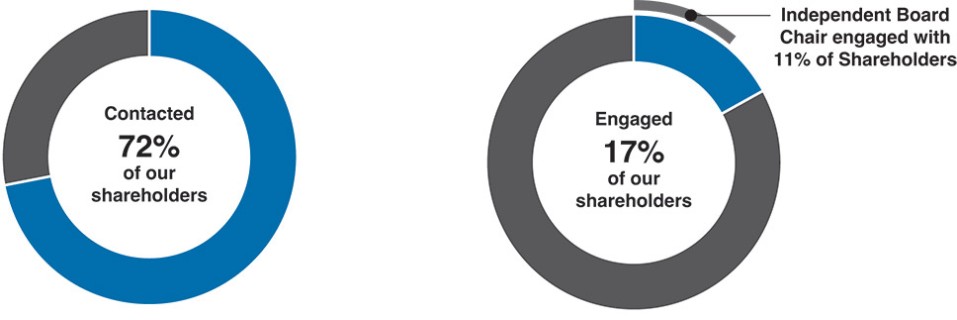

● Annual election of directors ● Annual advisory say-on-pay vote ● All director nominees other than our CEO are independent ● Independent Board Chair ● Independent committees ● Limit on directorships a Board member can hold ● Rigorous stock ownership guidelines for directors and certain key executives ● Anti-hedging and anti-pledging policy ● Ongoing succession planning for executive leadership team and directors ● 44% new directors since 2021 ● Proxy access rights for shareholders | ● Board committee oversight of environmental, social, and governance (“ESG”) matters ● Annual Board and committee self-assessments and individual director peer evaluations ● Resignation policy for directors not receiving a majority vote (see description below under subheading “Director Resignation Policy”) ● Active shareholder engagement (see description below under subheading “Shareholder Feedback and 2023 Say-on-Pay”) ● Adoption of Dodd-Frank compensation clawback policy and retention of existing incentive compensation clawback policy ● Worldwide Code of Business Conduct and Ethics, applicable to all directors, officers, and employees ● No shareholder rights plan (“poison pill”) |

COmmitment to board diversity

The Arrow Board prioritizes diversity in its recruitment of directors and has retained a recruitment firm to assist the Board in actively identifying and evaluating potential diverse Board candidates with the expectation that candidate slates should include women and candidates of underrepresented race/ethnicity in addition to other diverse characteristics, which both supplement and complement the existing Board. Arrow is committed to building a Board with a wide range of skills, experience, expertise, and diversity. Arrow’s Board consists of highly engaged, independent, and diverse directors that are actively involved in, among other things, strategic, risk, and management oversight.

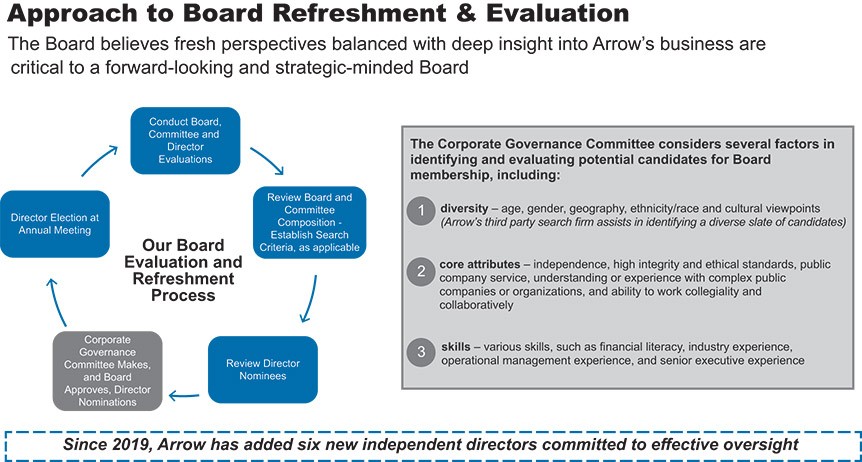

Board Refreshment

The Board believes the fresh perspectives brought by newer directors are critical to a forward-looking and strategic-minded Board when appropriately balanced with the deep understanding of Arrow’s business and independent institutional knowledge provided by longer-serving directors. Accordingly, Arrow has maintained a deliberate mix of new and longer-tenured directors on the Board, and the Corporate Governance Committee is focused on ensuring the optimal mix of tenures, backgrounds, skills, and perspectives for Arrow. Since 2019, Arrow has added six new directors – Messrs. Austen, Smith, Garcia, and Kerins, and Mses. Lowe and McDowell – each of whom have different backgrounds and experiences to further enhance the oversight of Arrow’s strategic goals and initiatives and contribute to the development and expansion of the Board’s knowledge and capabilities. As part of the Board’s active and comprehensive Board refreshment efforts, the Board has nominated a new director, Michael D. Hayford, for election to the Board at the Annual Meeting.

8 |

| |

Snapshot of Director Nominees

Below is a snapshot of the expected composition of Arrow’s Board immediately following the Annual Meeting, assuming the election of the ten (10) nominees named in this Proxy Statement. The slate of ten (10) director nominees includes three (3) female nominees and one (1) ethnically diverse nominee.

Skill/Experience | Nominees |

| |

| Leadership Experience | 10 | |

| Risk Management Experience | 6 | |

| Global Business and Operations Experience | 10 | |

| Financial Experience | 8 | |

| Legal and Regulatory Oversight Experience | 2 | |

| Technology and Cybersecurity Experience | 8 | |

| Supply Chain Management Experience | 5 | |

| Crisis Management Experience | 6 | |

| Strategy and M&A Experience | 10 | |

| Brand and Marketing Experience | 6 | |

| Corporate Governance Experience | 7 | |

| Human Capital Experience | 8 | |

| Environmental and Climate Strategy Experience | 5 | |

|

| 9 |

ENVIRONMENTAL, SOCIAL, AND GOVERNANCE OVERVIEW

At Arrow, we believe that doing good is good for business and our global community. We monitor and manage our ESG opportunities and impacts and engage with shareholders and other stakeholders with the goal of creating a better tomorrow and assuring the long-term viability of our Company.

To demonstrate Arrow’s commitment to the importance of these efforts, quantitative performance objectives related to carbon emission reduction and diversity and equality-related measures were components of our executive annual cash incentive plan for 2022 and 2023. Arrow intends to continue to evolve and integrate ESG into our strategy and operations and related disclosures.

To learn more, please refer to our 2023 ESG Report, available on our website at arrow.com/ESG. The 2023 ESG Report details Arrow’s ESG-related annual goals, progress updates, metrics, and initiatives. We invite you to review the 2023 ESG Report and share your thoughts with us at ESG@arrow.com.

Information on the Company’s website, including our ESG Reports, is not incorporated by reference into, and does not form part of, this Proxy Statement or any other report or document Arrow files with the SEC.

10 |

| |

PROPOSAL 1: ELECTION OF DIRECTORS

THE BOARD RECOMMENDS A VOTE “FOR” ALL OF THE NOMINEES NAMED BELOW.

If elected by our shareholders at the Annual Meeting, each nominee will serve for a one-year term expiring at our 2025 annual meeting of shareholders. Each nominee for election as a member of the Board of Directors of Arrow (the “Board”) is to be elected todirector will hold office until his or her successor has been elected and qualified or until the next Annual Meeting.director’s earlier resignation or removal.

All nominees identified below, except Michael D. Hayford, are current members of the Board. AllThey have been recommended for re-election to the Board by the Corporate Governance Committee and approved and nominated for re-election by the Board. The Board does not anticipate that any of the nominees named below will be unable or unwilling to serve as a director. If any nominee should refuse or be unable to serve, the proxy will be voted for a person designated by the Board, or in lieu thereof, the Board may reduce the number of directors. In accordance with the Company’s bylaws,by-laws (the “By-laws”), the nineten (10) nominees receiving a plurality of votes cast at the Annual Meeting will be elected directors, subject to the Director Resignation Policy described below.

An uncontested election of directors is not considered “routine” under the New York Stock Exchange (“NYSE”) rules. As a result, if a shareholder holds shares in “street name” through a broker, fiduciary, or other nominee,custodian, the broker, fiduciary, or nomineecustodian is not permitted to exercise voting discretion with respect to this proposal. For this reason, if a shareholder“street name” holder does not give histhe broker, fiduciary, or her broker or nomineecustodian specific instructions, the shareholder’s shares will not be voted on this proposal. If youproposal, which is referred to as a “broker non-vote.” Broker non-votes and withholding authority to vote to “abstain,” your shares will be counted as present at the meeting, and your abstentionfor a director nominee will have no effect on the effectoutcome of this proposal (though a vote againstdirector nominee that receives a greater number of “WITHHELD” votes than “FOR” votes in an uncontested election is required by the proposal.Board’s Director Resignation Policy to tender his or her resignation to the Board, as discussed in greater detail below under the heading “Director Resignation Policy”).

In accordance with the Company’s corporate governance guidelines,Corporate Governance Guidelines, members of the Board should have the following skills and abilities:

| > | the education, business experience, and current insight necessary to understand the Company’s business; |

| > | the ability to evaluate and oversee direction, performance, and guidance for the success of the Company; |

| > | the ability to primarily represent the interests of the Company’s shareholders while being attuned to the needs of the Company’s employees, the communities in which it operates, and other stakeholders, insofar as such conditions impact long-term shareholder value; |

| > | the ability to devote the necessary interest and time to fulfill all director responsibilities over a period of years, including committing to prepare for, attend, and meaningfully participate in substantially all scheduled Board and Board committee meetings; |

| > | independence and strength of conviction coupled with the ability to leave behind personal prejudice so as to be open to different points of view; |

| > | the willingness and ability to appraise the performance of executive management objectively and constructively and, when necessary, recommend appropriate changes; |

| > | avoid any activity or interest that might, or might appear to, conflict with his or her fiduciary responsibilities to the Company, except in unusual circumstances and then only with the formal approval of disinterested directors; and |

| > | all other criteria established by the Board from time to time, including functional skills or other attributes which will contribute to the development and expansion of the Board’s knowledge and capabilities. |

|

| 11 |

BOARD NOMINATIONS AND SUCCESSION

During the course of the year, the Corporate Governance Committee discusses Board succession and evaluates potential Board candidates. The Corporate Governance Committee has retained a third-party recruitment firm to assist in identifying and evaluating potential Board nominees.

The Company’s annual director nomination process involves formal assessments of qualifications, skills, and attributes necessary for successful contributions at the Board, Board committee, and individual director levels. This process assists the Board in determining who it should nominate to stand for election. In addition, the Corporate Governance Committee continually evaluates potential new candidates for Board membership, which is taken into account when it recommends nominees for election.

The Company uses the following process for assessing needs, identifying candidates, and nominating new director candidates for election.

| > | Conduct Board and Committee Evaluations. As required by the Company’s Corporate Governance Guidelines and the charters of the Audit Committee, the Compensation Committee, and the Corporate Governance Committee, the Board and each Board committee conduct annual self-evaluations of the effectiveness of the Board and each such committee. |

| > | Review Board and Committee Composition and Establish Search Priorities. Utilizing the results of the Board and Board committee self-evaluations and taking into account the Company’s strategic interests, its industry and market, the qualifications set forth in the Company’s Corporate Governance Guidelines, and other relevant considerations, the Corporate Governance Committee, in consultation with the Board, identifies the desired skills, attributes, expertise, experience, and background that would enable one or more additional directors to add value to the Board and its committees. If the Corporate Governance Committee determines to initiate a director search, it may engage a director search firm and provide the parameters for the search. |

| > | Review Director Candidates. Once a director search identifies potentially suitable candidates, the Corporate Governance Committee, with input from the entire Board, makes a list of final candidates. This list also includes any candidates duly submitted by shareholders. The Board Chair, Chief Executive Officer, and selected members of the Corporate Governance Committee then meet with each candidate to evaluate his or her suitability for Board membership in relation to the skills, attributes, expertise, experience, and background desired of a new director. |

| > | Recommendation and Nomination of Candidates for Board. If, based on the above review process, the Corporate Governance Committee identifies one or more suitable potential Board candidates, the Corporate Governance Committee will recommend the candidate(s) to the Board, and the Board will determine whether to nominate such candidate(s) for election by the shareholders at the next annual shareholder meeting; provided that any vacancy on the Board may be filled by a majority vote of the current Board, and any director elected by the Board to fill a vacancy will serve until the next annual shareholder meeting. |

| > | Director Election at Annual Meeting and Committee Assignments. All director nominees obtaining a plurality of the votes cast at the annual shareholder meeting will be elected to serve on the Board. At the Board meeting immediately following the annual shareholder meeting, the Corporate Governance Committee will make recommendations regarding, and the Board will ultimately approve, the committee assignments for the elected directors, including the committee chairs. |

12 |

| |

The below graphic summarizes the factors the Corporate Governance Committee considers in evaluating potential candidates for Board membership.

As a result of our comprehensive recruitment efforts, in 2023, the Company welcomed one new director to the Board, Ms. McDowell, who was elected to the Board at the 2023 annual shareholder meeting. In February 2024, the Corporate Governance Committee also recommended for nomination, and the Board nominated, Michael D. Hayford for election to the Board at the Annual Meeting. Mr. Hayford was identified by the Company’s business. Members ofthird - party executive recruitment firm and, if elected to the Board must be ableat the Annual Meeting, will bring deep public - company and technology industry experience to evaluate and oversee its direction and performance for the Company’s continued success. The directors should also possess such functional skills, corporate leadership, and international experience required to contribute toBoard, as further described below under the development and expansionheading “Biographies of the Board’s knowledge and capabilities. Moreover, the directors should have the willingness and ability to objectively and constructively appraise the performance of executive management and, when necessary, recommend appropriate changes.Director Nominees.”

The Corporate Governance Committee has a thoughtful policy regarding diversity. considers shareholder recommendations of Board nominees as well as those recommended by current directors, officers, employees, and others. Such recommendations may be submitted to Arrow’s Chief Governance, Sustainability, and Human Resources Officer, Gretchen Zech, at Arrow Electronics, Inc., 9151 East Panorama Circle, Centennial, Colorado 80112, who will forward them to the Corporate Governance Committee. Possible candidates suggested by shareholders are evaluated by the Corporate Governance Committee in the same manner as other candidates.

DIVERSITY

Whenever the Corporate Governance Committee evaluates a potential candidate for Board membership, it considers that individual in the context of the composition of the Board as a whole. TheWhile the Company does not have a formal diversity policy, the Board believes that its membership should reflect diversity in its broadest sense to include, among other factors, age, gender, geography, ethnicity/race, and consistentcultural viewpoints. Consistent with that philosophy, the Board doeshas taken measures to diversify its makeup:

| > | All but one of the Company’s director nominees (i.e., Mr. Kerins) are independent and have a broad range of experience in varying fields, including, among others, software development and sales, business strategy consulting, hospitality services, consumer products, electronics and computer hardware manufacturing and distribution, business services, and telecommunication products and cloud services. |

| > | 30% of the director nominees are women, and 10% are racially/ethnically diverse. |

|

| 13 |

| > | A majority of the Company’s director nominees hold or have held directorships at other U.S. public companies. |

| > | Eight of the director nominees, including the Company’s CEO, have served as chief executive officers, and all have demonstrated superb leadership, intellectual, and analytical skills gained from deep experience in management, finance, and corporate governance. |

| > | The Board has retained a recruitment firm to assist the Corporate Governance Committee in actively identifying and evaluating potential diverse Board candidates and sets clear expectations that candidate slates should include women and candidates of underrepresented race/ethnicity in addition to other diverse characteristics, which both supplement and complement the existing Board. |

The Corporate Governance Committee is focused on continued diversity on the Board as it believes that the varied perspectives and experiences resulting from having a diverse Board enhance the quality of decision making. In particular, the Board is committed to identifying and evaluating highly qualified Board candidates who are women and/or are from an under-represented community as well as candidates with other diverse backgrounds, industry experience, and other unique characteristics. For example, three recent additions to the Board, Mary T. McDowell, Carol P. Lowe, and Fabian T. Garcia, have collectively added valuable gender, ethnic, and geographic/cultural diversity.

The Corporate Governance Committee recognizes the evolving support for boards to achieve a target of 30% women representation. The Board currently has 33% gender diversity. If all of the Company’s director nominees are elected at the Annual Meeting, the Board would have 30% gender diversity. Over the course of 2024, the Board expects to continue to work closely with the Corporate Governance Committee to identify potential additions to the Board and expects to consider a candidate’sin its evaluation potential candidates’ diversity characteristics that may supplement and complement the existing Board. None of the Company’s director candidates are discriminated against on the basis of race, religion, national origin, sex, sexual orientation, disability, or any other basis proscribed by law.

14 |

| |

Director Nominee Diversity and Experience Matrix*

Z | | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

10 Director Nominees: | William | Fabian | Steve | Gail | Michael | Andrew | Sean | Carol | Mary | Gerry | |

Experience and Skills | | | | | | | | | | | |

Leadership | Leadership experience facilitates effective oversight of management, informs development of Company strategy, and enhances the Board’s succession planning process. | ||||||||||

|

|

|

|

|

|

|

|

|

| ||

Risk Management | Experience assessing and managing risk enables directors to effectively oversee and mitigate the most significant risks facing Arrow. | ||||||||||

| |

| | |

|

|

| |

| ||

Global Business and Operations | Background and experience managing global relationships and engaging with international stakeholders supports the Board’s oversight of key risks involving our global customer and supplier bases and of strategic decision-making relating to our complex worldwide business. | ||||||||||

|

|

|

|

|

|

|

|

|

| ||

Financial | Demonstrated financial experience enables in-depth analysis of our financial statements and informed decision-making regarding our capital structure, financial transactions, and financial reporting processes. | ||||||||||

| |

|

|

|

|

|

|

| |||

Legal and Regulatory | Experience with legal and regulatory oversight enables directors to effectively oversee compliance with legal and regulatory requirements and the related policies, procedures, and controls for ensuring such compliance. | ||||||||||

| |

| |

| | | | | | ||

Technology and Cybersecurity | Experience navigating the ever-changing technology landscape enables sharpened oversight of the innovative products, services, and systems central to our business and supports the Company’s long-term strategic planning. Experience with privacy and information security and cybersecurity oversight is critical to helping Arrow manage and plan to defend against significant cybersecurity risks. | ||||||||||

| | |

|

|

|

|

|

|

| ||

Supply Chain Management | Substantial knowledge of supply chain management enables enhanced oversight of our product and service offerings and sharpens focus on our business strategy to be the premier, technology-centric, go-to-market, and supply chain services company on the planet. | ||||||||||

| | | |

|

|

| |

|

| ||

Crisis Management | In conjunction with the Board’s oversight of Arrow’s overall enterprise risk management, crisis management experience allows the Board to assist the Company in mapping out a crisis response plan and navigating a crisis in the rare event one should occur. | ||||||||||

| |

| |

|

| | |

|

| ||

Strategy and M&A | Experience in strategic planning and mergers and acquisitions is critical in formulating and implementing Arrow’s continued growth strategy. | ||||||||||

|

|

|

|

|

|

|

|

|

| ||

Brand and Marketing | Brand and marketing experience enables the Board to provide valuable insight into the alignment of brand definition with Arrow’s long-term strategy as a driver of value. | ||||||||||

|

|

|

|

|

| | |

| | ||

Corporate Governance | Directors with experience in corporate governance assist the Company in implementing effective and compliant corporate governance practices for the benefit of our various stakeholders in the continually evolving corporate governance landscape. | ||||||||||

| |

|

| |

| |

|

|

| ||

Human Capital | Human capital management experience supports the Board’s oversight of the development, implementation, and effectiveness of practices, policies, and strategies relating to Arrow’s workforce, including talent attraction and development, corporate culture, and diversity and inclusion. | ||||||||||

| |

|

|

|

|

| |

|

| ||

Environmental and Climate Strategy | Experience in climate change risk management strategies and other climate-related issues enables enhanced Board oversight of environmental and climate related policies, strategies, compliance, and priorities. | ||||||||||

|

|

| | |

| | | |

| ||

|

| 15 |

10 Director Nominees: | William | Fabian | Steve | Gail | Michael Hayford | Andrew | Sean | Carol | Mary | Gerry |

Background | | | | | | | | | | |

Gender Identity | | | | | | | | | | |

Male |

|

|

| |

|

|

| | |

|

Female | | | |

| | | |

|

| |

Non-binary | | | | | | | | | | |

Race | | | | | | | | | | |

American Indian or Alaska Native | | | | | | | | | | |

Asian | | | | | | | | | | |

Black or African American | | | | | | | | | | |

Hispanic or Latino | |

| | | | | | | | |

Native Hawaiian or other Pacific Islander | | | | | | | | | | |

White |

| |

|

|

|

|

|

|

|

|

Age/Tenure | | | | | | | | | | |

Age | 65 | 64 | 66 | 74 | 64 | 60 | 62 | 58 | 59 | 60 |

Years on the Board | 4 | 3 | 7 | 16 | 0 | 14 | 2 | 3 | 1 | 4 |

* This matrix illustrates the experience, education, gender, race, ethnicity, geographic location,skills, qualifications, and differencecharacteristics of viewpoint when evaluating his or her qualificationsthe individuals nominated for election to the Board. Board at the Annual Meeting, based on information self-reported to the Company by each applicable individual.

16 |

| |

BIOGRAPHIES OF DIRECTOR NOMINEES

Based on theeach nominee’s experience, attributes, and skills, which exemplify the sought-after characteristics described above, the BoardCorporate Governance Committee has concluded that each nominee possesses the appropriate qualifications to serve as a director of the Company.

Independent Board Chair | Steven H. Gunby | Age: 66 | Director Since: 2017 | ||

| |||||

|

|

|

| |

|

|

| |

|

|

| 2014. | ||

● Senior Partner and Global Leader of Transformation from ● Senior Partner and Chairman, North and South America from 2003 to 2009. ● Held other major managerial roles in his capacity as a Senior Partner and Managing Director, | Breakthru Beverage Group LLC ● A director (a private company) from 2016 to 2018. | ||

REASONS FOR NOMINATION

CURRENT PUBLIC COMPANY DIRECTORSHIPS (OTHER THAN ARROW) ●FTI Consulting, Inc. | |||

Independent Director Committees: Compensation & Corporate Governance (Chair) |

| Age: 65 Director Since: 2020 | |

CAREER HIGHLIGHTS | |||

Bemis Company, Inc., a global manufacturer of flexible packaging products and pressure-sensitive materials ● President, Chief Executive Officer, and director from 2014 until Bemis was acquired by Amcor Limited in 2019. ● Executive Vice President and Chief Operating Officer from 2013 to 2014. ● Group President of Global Operations from 2012 to 2013. ● Vice President of Operations from 2004 to 2012. | Morgan Adhesives Company ● President and Chief Executive Officer from 2000 to 2004. General Electric Company ● Various positions from 1980 to 2000. Tennant Company ● A director (a public company) from 2007 to 2022. Arconic Corporation ● A director (a public company) from 2020 to 2023. | ||

REASONS FOR NOMINATION As President and CEO of Bemis, a complex global material science and manufacturing company, Mr. Austen gained expertise in global manufacturing and operations, together with experience in international mergers and acquisitions and business integration. The Board believes that Mr. Austen’s experience with building high-performance, cross-functional teams coupled with his engineering background make him particularly valuable in guiding strategy for the Company’s engineering services. CURRENT PUBLIC COMPANY DIRECTORSHIPS (OTHER THAN ARROW) ●None | |||

|

| 17 |

|

|

Independent Director Committees: Compensation | Fabian T. Garcia | Age: 64 Director Since: 2021 | |

CAREER HIGHLIGHTS | |||

Unilever PLC., a British multinational consumer goods company ● President, Personal Care, and member of the Unilever Leadership Executive since 2022. ● President, Unilever North America, and member of the Unilever Leadership Executive from 2020 to 2022. The Boston Consulting Group, an American global management consulting firm ● Senior Advisor for consumer-packaged goods from 2018 to 2019. Revlon, Inc. ● President, Chief Executive Officer, and director from 2016 to 2018. Colgate-Palmolive Company ● Various positions from 2003 to 2016, beginning as President, Asia Pacific & Greater Asia Division, continuing as President, Latin America & Global Sustainability, and culminating as Chief Operating Officer, Global Innovation and Growth. | The Timberland Company ● Senior Vice President, International Relations, from 2002 to 2003. Chanel Ltd. ● President, APAC and Member of the Executive Committee from 1996 to 2001. Procter & Gamble Company ● Various positions in the U.S., Japan, Taiwan, Venezuela, and Colombia, from 1980 to 1994. Kimberly-Clark Corporation ● A director (a public company) from 2011 to 2019. | ||

REASONS FOR NOMINATION Mr. Garcia is a global business leader with a strong track record and deep experience, including his tenure as a public company CEO, with a keen understanding of global business strategy, international innovation and growth, geopolitical sensitivities, and financial, operational, and strategic leadership skills. The Board believes that Mr. Garcia’s multicultural and global experience is especially valuable in guiding the Company’s international strategy and fostering sustainable business practices and an inclusive corporate culture. CURRENT PUBLIC COMPANY DIRECTORSHIPS (OTHER THAN ARROW) ●None | |||

18 |

| |

Independent Director Committees: Audit & Corporate Governance | Gail E. Hamilton | Age: 74 Director Since: 2008 | |

| |||

Symantec Corporation ● Executive Vice President Compaq Computer Corporation ● Vice President and Hewlett-Packard Company ● General Manager of the Telecom Platform Division | OpenText Corporation ● A director Ixia (acquired by Keysight Technologies in 2017) ● A director (a public company) from 2005 to 2017. Westmoreland Coal ● A director | ||

REASONS FOR NOMINATION Ms. Hamilton was responsible for designing, manufacturing, and selling electronic systems for more than 20 years. While at Symantec, a leading software company, Ms. Hamilton oversaw the profit and loss and operations of the enterprise and consumer business. In that role, she was responsible for business planning and helped steer the company through an aggressive acquisition strategy. She also oversaw Symantec’s cybersecurity function and services. The Board believes that Ms. Hamilton’s experience at Symantec CURRENT PUBLIC COMPANY DIRECTORSHIPS (OTHER THAN ARROW) ●Open Text Corporation | |||

|

| Age: 64 Director Since: -- | |

CAREER HIGHLIGHTS | ||||

● Chief Executive Officer from ● A director (public company) from 2018 to 2023. Motive Partners ● Founder and Senior Advisor from 2015 to 2018. Fidelity National Information Services, Inc. ● Executive Vice President and Chief Financial Officer from 2009 to 2013. National Infrastructure Advisory Council, an executive-branch council focused on critical infrastructure security and resilience ● Member since 2022 (appointed by the President of the United States). | Metavante Technologies, Inc. ● A director (public company) from 2007 to 2009. ● President and Chief Operating Officer from 2007 to 2009. ● Chief Financial Officer from 2001 to 2006. ● Other senior positions of increasing seniority from 1992 to 2001. Endurance International Group Holdings ● A director (public company) from 2013 West Bend Mutual Insurance Company ● A director (private company) from 2006 to 2018. | |||

REASONS FOR NOMINATION Mr.

|

| |||

|

| ||

|

|

|

| |

CURRENT PUBLIC COMPANY DIRECTORSHIPS (OTHER THAN ARROW) ●None |

|

| 19 |

Independent Director Committees: Compensation & Corporate Governance | Andrew C. Kerin | Age: 60 Director Since: 2010 | |

CAREER HIGHLIGHTS | |||

● Chief Executive Officer The Brickman Group, Ltd. ● Chief Executive Officer and a director | Aramark Corporation ● Executive Vice President ● Executive Vice President ● Elected as an executive officer ● President, Aramark Healthcare and ● A number of other management roles within Aramark Corporation. Under his leadership were all of Aramark’s food, hospitality, and facilities businesses, including the management of professional services in healthcare institutions, universities, schools, business locations, entertainment and sports venues, correctional facilities, and hospitality venues. | ||

REASONS FOR NOMINATION Mr. Kerin brings over 30 years of experience leading business service companies and building service teams across the globe. The Board believes that Mr. Kerin’s CURRENT PUBLIC COMPANY DIRECTORSHIPS (OTHER THAN ARROW) ●None | |||

20 |

| |

President and Chief Executive Officer | Sean J. Kerins | Age: 62 Director Since: 2022 | |

CAREER HIGHLIGHTS | |||

Arrow Electronics, Inc. ● President, Chief Executive Officer, and director since 2022. ● Chief Operating Officer from 2020 to 2022. ● President, Global Enterprise Computing Solutions from 2014 to 2020. ● President, North American Enterprise Computing Solutions from 2010 to 2014. ● Vice President, Storage and Networking from 2007 to 2010. | EMC Corporation ● Several sales, marketing, and professional services roles around the world from 1997 to 2007. Other Experience ● Various roles with Coopers & Brand Consulting and General Motors. | ||

REASONS FOR NOMINATION Mr. Kerins has served for 17 years at the Company in progressively more senior leadership and executive roles. The Board believes Mr. Kerins brings value to the Board from his comprehensive understanding of the Company’s business and deep institutional knowledge of the Company. The Board believes that in Mr. Kerins’ role as CEO of the Company, Mr. Kerins can effectively communicate Board priorities to Company management and provide insight and feedback to the Board on behalf of Company management. CURRENT PUBLIC COMPANY DIRECTORSHIPS (OTHER THAN ARROW) ●None | |||

Independent Director Committees: Audit (Chair) & Corporate Governance | Carol P. Lowe | Age: 58 Director Since: 2021 | |

CAREER HIGHLIGHTS | |||

FLIR Systems, Inc., a thermal imaging company ● Executive Vice President and Chief Financial Officer from 2017 to 2021. Sealed Air Corporation ● Senior Vice President and Chief Financial Officer from 2011 to 2017. Carlisle Companies Incorporated ● President, Carlisle Food Service Products in 2011. ● President, Trail King Industries from 2008 to 2011. ● Vice President and Chief Financial Officer from 2004 to 2008. | TCW Special Purpose Acquisition Corp. ● A director (a public company) from 2021 to 2022. EMCOR Group, Inc. ● A director (a public company) since 2017. Other Experience ● A director of Duravant (a private company) since 2023. ● A director of Novolex (a private company) since 2021. ● Member of the Board of Visitors and Finance Committee, Fuqua School of Business since 2017. | ||

REASONS FOR NOMINATION Ms. Lowe has valuable experience and a depth of knowledge in many aspects of finance, as well as business services, strategic planning, business development, and information technology. The Board believes that her record of instilling knowledge-based, performance-driven cultures throughout her career enables her to provide insightful contributions to the Company. Ms. Lowe is considered an “audit committee financial expert” as the term is defined in Item 407(d) of Regulation S-K. CURRENT PUBLIC COMPANY DIRECTORSHIPS (OTHER THAN ARROW) ●EMCOR Group, Inc. | |||

|

| 21 |

|

|

Independent Director Committees: Audit |

| Age: 59 Director Since: 2023 | |

CAREER HIGHLIGHTS | |||

Mitel Networks Corporation, a global provider of telecommunication products and cloud services ● President and Chief Executive Officer from 2019 to 2021. ● A director (private company) from 2019 to 2022, and Board Chair from 2021 to 2022. Polycom, Inc., an audio and video technology developer ● Chief Executive Officer and a director (private company) from 2016 to 2018. The Informa Group plc ● A director (UK public company) since 2018. ● Senior Independent Director since 2021. | Bazaarvoice, Inc. ● A director (public company) from 2014 to 2016, and Compensation Committee Chair from 2015 to 2016. UBM plc. ● A director (UK public company) from 2014 to 2018. Autodesk, Inc. ● A director (public company) since 2010. ● Compensation Committee Chair since 2012. Other Experience: ● Served as Executive Vice President at Nokia from 2004 to 2012. ● Served in various executive, managerial, and other positions with Compaq Computer Corporation and Hewlett-Packard Company. | ||

REASONS FOR NOMINATION Ms. McDowell has strong strategic and operational leadership experience developed over an extensive career in the technology industry, owing to her previous roles as chief executive officer of two global technology-focused organizations and the chair of a corporate board of directors. The Board believes that this background allows Ms. McDowell to effectively contribute to the Board’s overall leadership structure and provide valuable insights into the Company’s core businesses and the markets in which they operate. Ms. McDowell also has a proven track record leading strategic transformations and implementing cutting-edge innovation in the fast-moving technology space, including for global businesses with diverse product lines and extensive distribution networks, which the Board believes will help the Company develop, refine, and implement the Company’s growth strategy. CURRENT PUBLIC COMPANY DIRECTORSHIPS (OTHER THAN ARROW) ●Autodesk, Inc. ●The Informa Group plc (London Stock Exchange) | |||

22 |

| |

Independent Director Committees: Compensation (Chair) | Gerry P. Smith | Age: 60 Director Since: 2020 | |

CAREER HIGHLIGHTS | |||

● Chief Executive Officer and director (a public company) since 2017. Zero100, a global coalition accelerating progress to zero-percent carbon and 100% digital supply chains ● Founding member of Lenovo Group Limited ● Executive Vice ● Executive Vice President and President of ● Chief Operating Officer of the Personal Computing Group and Enterprise ● President of the Americas from 2013 to 2015. | Lenovo Group Limited (continued) ● President, North America and Senior Vice President, Global Operations from 2012 to 2013. ● Senior Vice President of Global Supply Chain from 2006 to 2012. Dell Inc. ● Served in a number of roles from 1994 to 2006. | ||

REASONS FOR NOMINATION Mr.

●The ODP Corporation | |||

|

| 23 |

| |

|

|

|

| ||

The Board has adopted a Director Resignation Policy which provides that in an uncontested election, any director nominee that receives a greater number of votes “withheld”“WITHHELD” from his or her election than votes “for”“FOR” his or her election must tender a letter of resignation to the Board within five days of the certification of the shareholder vote.vote for consideration by the Corporate Governance Committee. The Corporate Governance Committee must then consider whether to recommend that the Board accept or reject the director’s resignation and promptly make such a recommendationrecommendation. The Board must then take action with respect to the Board. The Board will then consider the resignation and, within 90 days following the date of the shareholders’ meeting at which the election occurred shalland then publicly disclose its decision.decision in a Form 8-K filed with the SEC. A director whose resignation is under consideration may not participate in any deliberationthe deliberations of the Corporate Governance Committee or Board regarding his or her resignation. The Director Resignation Policy can be found under “Governance Documents” at the “Leadership &and Governance” sublinksub-link of the Investor Relations dropdowndrop-down menu on investor.arrow.com.

24 |

| |

2024 ANNUAL |

| |

PROXY STATEMENT |

|

TheIn 2023, the Board meets inmet in: (i) general sessions withpresided over by the Chairman ofExecutive Chair (for sessions prior to the 2023 annual shareholder meeting) and independent Board presiding, inChair (for sessions after the 2023 annual shareholder meeting), (ii) meetings limited to non-managementnon- management directors (which are ledmeetings were presided over by the Lead Director)Independent Director prior to the 2023 annual shareholder meeting and presided over by the independent Board Chair after the 2023 annual shareholder meeting), and (iii) in its three various committees. Committee meetings are open to all members of the Board.Board other than management directors during the sessions of the non-management directors of such committee meetings.

Committee memberships and chair assignments are reviewed no less than annually by the Corporate Governance Committee, which makes appointmentcommittee appointments and chair recommendations to the Board.

The Tabletable below reflectsshows current committee memberships for calendar year 2017.as of the date of this Proxy Statement.

| | | | | | | | | |||||||

| | | | Committee | |||||||||||

Name | Independent | Audit | Compensation | Corporate | |||||||||||

William F. Austen | |||||||||||||||

| |||||||||||||||

|

|

| |||||||||||||

|

|

|

|

|

|

|

| ||||||||

| | X | | | | M |

| C | |||||||

| | X | | | | M | | | |||||||

Steven H. Gunby (1) | | X | | | | | | | |||||||

Gail E. Hamilton | | X | | M |

| | |||||||||

|

| ||||||||||||||

|

|

|

| M | |||||||||||

| | X | | | | M |

|

| |||||||

|

|

|

|

| M | ||||||||||

| | | | | | | | | |||||||

Carol P. Lowe | | X | | C |

| | |||||||||

|

|

|

|

| |||||||||||

| |||||||||||||||

|

|

|

|

| M | ||||||||||

| | X | | M | | | | | |||||||

Gerry P. Smith | | X | | | | C | | | |||||||

C= Chair M= Member

| (1) | Mr. Gunby was appointed to serve as independent Board Chair at the meeting of the Board immediately following the 2023 annual shareholder meeting. |

BOARD LEADERSHIP STRUCTURE

The Board annually elects a Chair after taking into account the recommendation of the Corporate Governance Committee following its annual review of the Board’s leadership structure, which typically takes place immediately after the annual shareholder meeting.

Among other responsibilities, the Board Chair:

| ● | acts as the key liaison between the Board and management; |

| ● | sets timing, location, and agendas for meetings of the Board (in consultation with senior management of the Company and committee chairs); |

| ● | sets the agenda and chairs all executive sessions of the independent directors; |

| ● | presides over Board and shareholder meetings; |

| ● | works closely with the Corporate Governance Committee to recommend committee chairs and committee assignments; |

|

| 25 |

(1)

| ● | assists the Corporate Governance Committee in evaluating whether to nominate additional directors for Board membership; and |

| ● | may call special meetings of the Board. |

The Company does not require the separation of its Chair and CEO positions, but they are currently separate. The Board believes it is in the best interests of the Company to determine the separation of its Chair and CEO position based upon the circumstances at the time. As described under “Proxy Statement Highlights – Board Leadership Transition” above, in 2023 Mr. Gunby was appointedLong concluded his service as Executive Chair and a board member effective December 12, 2017.

(2)Mr. Hanson retired as a board member effective December 13, 2017.

In accordance withof the Company’s corporate governance guidelines,Board at the conclusion of the 2023 annual shareholder meeting on May 17, 2023, and the Board appointed Mr. Perry to serveGunby as independent Board Chair immediately following the Lead Director. The Lead Director chairs2023 annual shareholder meeting.

In situations where the Board meetings when the ChairmanChair is not present. He also chairs the sessions of the non-management directors held in connection with each regularly scheduled Board meeting. The Lead Director serves as a liaison between the Chairman and the independent, non-management directors, and reviews and approves Board agendas and meeting schedules. The Lead Director has the authority to call meetings of the non-management directors.

|

| ||

|

|

|

CHIEF EXECUTIVE OFFICER AND CHAIRMAN POSITIONS

The Company’s Chief Executive Officer currently serves as Chairman of the Board. In his position as Chief Executive Officer, Mr. Long has primary responsibility for the day-to-day operations of the Company and provides consistent leadership on the Company’s key strategic objectives. In his role as Chairman, he sets the strategic priorities forCorporate Governance Guidelines suggest the Board presides over its meetings, and communicates its findings and guidance to management. The Board believes that the combination of these two roles is the most appropriate structure for the Company at this time because: (i) this structure provides more consistent communication and coordination throughout the organization, which results inappoint a more effective and efficient implementation of corporate strategy; (ii) it unifies the Company’s strategy behind a single vision; (iii) the Chief Executive Officer is the most knowledgeable member of the Board regarding risks the Company may be facing and, in his role as Chairman, is able to facilitate the Board’s oversight of such risks; (iv) the structure has a long-standing history of serving the Company’s shareholders well through many economic cycles, business challenges, and succession of multiple leaders; (v) the Company’s current corporate governance processes, including those set forth in the various Board committee charters and corporate governance guidelines, preserve and foster independent communication amongst non-management directors as well as independent evaluations of and discussions with the Company’s senior management, including the Company’s Chief Executive Officer; and (vi) the role of the Lead Director, which fosters better communication among non‑management directors, fortifies the Company’s corporate governance practices, making the separation of the positions of Chairman of the Board and Chief Executive Officer unnecessary at this time.Independent Director.

COMMITTEES

In compliance with the pay ratio disclosure requirement of the Dodd-Frank Wall Street Reform and Consumer Protection Act, the Company determined that the 2017 annual total compensation of the median compensated of all its employees who were employed as of December 31, 2017, other than its CEO, Mr. Long, was $53,310; Mr. Long’s 2017 annual total compensation was $10,994,551, and the ratio of these amounts was 1-to-206.

The following summarizes the methodology, material assumptions, adjustments, and estimates the Company used for calculating the CEO pay ratio:

> Employee Measurement Date: The Company utilized the entire global population of approximately 19,000 eligible employees on December 31, 2017.

> Exclusions: The number of US and non-US employees prior to exemption were approximately 7,000 and 12,000, respectively. Employees from the following non-US jurisdictions that collectively constitute 5% or less of the total global workforce were excluded: India, Indonesia, Latvia, Lithuania, Malaysia, Ukraine, and Vietnam. The total number of employees excluded was approximately 900. Therefore, the total number of US and non-US employees used in the final analysis was 7,000 and 11,100, respectively.

> Compensation Time Period: The Company measured compensation for the above employees using the 12-month period ending December 31, 2017.

> Consistently Applied Compensation Measure: Target total cash (base + target bonus) was selected as the consistently applied compensation measure used to identify the median employee. The Company used existing data from its global Human Resource information system to identify the median employee. Base pay for hourly employees was calculated based on a reasonable estimate of hours worked (including overtime) in 2017, and on salary levels for all remaining employees.

> Determining the Median Employee: Using this methodology, the Company determined that its median employee was a full-time, hourly employee, with wages and overtime pay for the 12-month period ending December 31, 2017 in the amount of $50,919.

|

|

|

|

|

> Determining Median Employee’s Pay for CEO Ratio: With respect to its median employee, the Company then identified and calculated the elements of such employee’s compensation for fiscal 2017 in accordance with the requirements of Item 402(c)(2)(x) of Regulation S-K, resulting in annual total compensation in the amount of $53,310. The difference between such employee’s wages and the employee’s annual total compensation represents the estimated value of such employee’s retirement-related benefits, which is $2,391.

> Determining CEO’s Pay for CEO Ratio: With respect to the annual total compensation of its CEO, the Company used the amount reported in the “Total” column of its 2017 Summary Compensation Table included in this Proxy Statement.

This pay ratio is a reasonable estimate calculated in a manner consistent with SEC rules based on Arrow’s payroll and employment records and the methodology described above. Because the SEC rules for identifying the median compensated employee and calculating the pay ratio based on that employee’s annual total compensation allow companies to adopt a variety of methodologies, to apply certain exclusions, and to make reasonable estimates and assumptions that reflect their compensation practices, the pay ratio reported by other companies may not be comparable to the pay ratio reported above, as other companies may have different employment and compensation practices and may utilize different methodologies, exclusions, estimates and assumptions in calculating their own pay ratios.

Each of the committees of the Board operates under a charter, copies of which are available under “Governance Documents” at the “Leadership &and Governance” sublinksub-link of the Investor Relations drop downdrop-down menu on investor.arrow.com. As a matterinvestor.arrow.com.

26 |

| |

Audit Committee

| ||

Current Members |

| |

Gail E. Hamilton

| | auditor |

| ||

Key Activities in 2023 | ||

● Supervised Arrow’s ethics and compliance program, including regular review of whistleblower hotline complaints ● Received regular cybersecurity updates from management and discussed cybersecurity risk ● Reviewed and recommended to the Board expansion of the Company’s share repurchase program and approval of other financing transactions ● Reviewed and recommended to the Board updates to its committee charter ● Received regular updates from management on legal and regulatory developments ● Adopted improvements to the Company’s disclosure controls and procedures, including relating to evaluation of cybersecurity incidents for required disclosure | ||

* | The Board has determined that Ms. Lowe is qualified as an “audit committee financial expert,” as the term is defined in Item 407(d) of Regulation S-K. |

|

| 27 |

The Board has determined that Mrs. Keeth and Mr. Patrick are qualified as “audit committee financial experts,” as the term is defined in Item 407(d) of Regulation S-K.

|

| ||

William F. Austen Fabian T. Garcia Andrew C. Kerin | | |

|

| |

|

|

| ||

Key Activities in 2023 | ||

● Managed compensation-related decisions to facilitate successful leadership transitions ● Received regular updates from management on the Company’s human capital strategy and oversaw the development of the human-capital related disclosures in Arrow’s ESG report ● Reviewed and recommended to the Board the adoption of a Dodd-Frank compensation clawback policy, updates to its existing incentive compensation clawback policy, and updates to its committee charter | ||

The Compensation Committee may delegate authority from time to time to a subcommittee of one or more members of the Compensation Committee or to the CEO, if and when the Committee deems appropriate and in accordance with its charter and applicable rules and regulations. In 2017,2023, the Compensation Committee directly engaged Pearl Meyer & Partners (“Pearl Meyer”) as a consultant to examine and report exclusively to the Compensation Committee on best practices in the alignment of compensation programs for the Chief Executive OfficerCEO and other members of senior management by providing competitive benchmarking data, analyses, and recommendations with regard to plan design and target compensation. In addition, Pearl Meyer & Partnersprovides guidance to the Corporate Governance Committee regarding non-management director compensation. Pearl Meyer does not provide any other services to the Company. TheseThe Company has determined that the services to the Compensation Committeerendered by Pearl Meyer have not raisedand do not raise any conflicts of interest.

Corporate Governance Committee

28 |

| |

Corporate Governance Committee

| ||

Current Members | |

|

William F. Austen, Chair Gail E. Hamilton Andrew C. Kerin

| | implements, and monitors Arrow’s Corporate Governance Guidelines or to fill existing or expected director vacancies |

| ||

Key Activities in 2023 | ||

● Recommended the appointment of an independent Board Chair ● Identified, reviewed, and recommended for the Board’s nomination, a new ● Reviewed the Company’s ESG developments and oversaw the preparation and publication of the Company’s ESG report ● Reviewed and recommended to the Board approval of updates to the Company’s Worldwide Code of Business Conduct and Ethics, Corporate Governance Guidelines, its committee charter, and various other internal policies and procedures ● Helped facilitate certain management changes during 2023 by recommending such changes to the Board ● Reviewed and recommended to the Board modifications to the compensation of the Company’s independent Board Chair to ensure the compensation for | ||

|

| 29 |